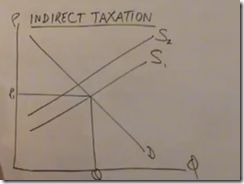

How does elasticity of supply and demand affect incidence of tax?

pajholden explains the effect of indirect taxation. Note he concentrates mainly on specific tax but includes a brief section on ad valorem (percentage) tax later on. Click below.

A much longer (and therefore detailed) video by jodiecongirl. Use these if you really haven’t yet understood the key concepts, as these will take you through it slowly and step by step.

She also goes into depth about the impacts on producers and consumers in the following videos but this gets quite complex. (more suited to IB level):

General Rules About Taxes Part 1

General Rules About Taxes Part 2

A much briefer summary is here by agsmandrew and he manages to explore the impact on consumer and producer surplus (including deadwight loss) (good for a quick revision for IB students):

Visit this site and explore different possibilities on a supply/demand graph with varying levels of tax applied. Try answering the questions at the bottom. (Note – the graph also refers to Efficiency Loss which is not actually required on the IGCSE syllabus, but is necessary to IB Economics).

![]() McConnell Brue Economics – Online Learning Centre – Interactive Graphing Exercise – Tax Incidence

McConnell Brue Economics – Online Learning Centre – Interactive Graphing Exercise – Tax Incidence

| Print article | This entry was posted by James Penstone on November 2, 2010 at 7:37 am, and is filed under Economics, IB Economics, IGCSE Economics, Microeconomics. Follow any responses to this post through RSS 2.0. You can leave a response or trackback from your own site. |