Understanding the Balance of Payments

This can be a difficult concept to understand (especially at IGCSE level, less so at IB level), mainly because we are trying to understand how an entire country manages its financial accounts of all transactions between itself and other countries. The real difficulty, i find, is that different nations take different approaches which means that there is no uniform ‘model’ of what Balance of Payments should be structured. In some cases, different phrases are used for the same thing (always a source of frustration to students when learning something first time round). Text books and online articles (try this and here) have plenty to say about it, but here are a few resources designed to help simplify understanding.

Here is a skeleton outline of the B of P, which is perhaps oversimplified. A student in my class typed notes from my whiteboard scrawl (thanks Jonathan):

This youtube video by pajholden helps understand the Current Account structure from a UK perspective: ‘balance of payments – structure of the current account ‘

Below, this simple interactive drag and drop exercise hosted at www.reffonomics.com is a useful reminder of how different ‘components’ of the Balance of Payments can be classified. Click on the table / image below.

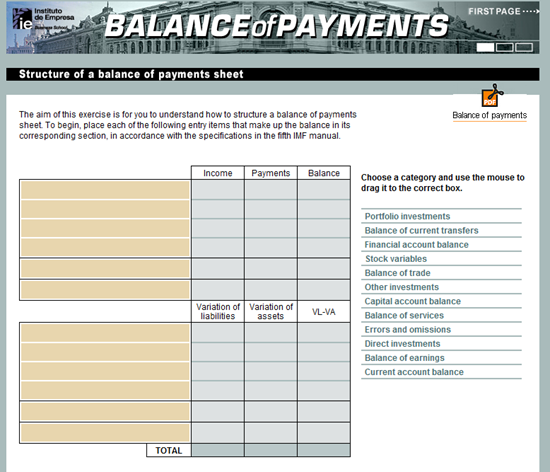

Below, there is another really helpful interactive exercise by Rafael Pampillon hosted at http://openmultimedia.ie.edu to play around with the different components of the Balance of Payments, where they might be placed and how they might be applied. You are advised to read the guide attached to the .swf file (top right hand corner) but even if time does not allow for this, it is good to experiment as the feedback will help you realise the correct answers with a bit of trial and error). Click on the image below to access the page.

Finally, here is a bit more detail from http://tutor2u.net on the topic (better for IB level than IGCSE level):

http://tutor2u.net/economics/revision-notes/as-macro-balance-of-payments.html

| Print article | This entry was posted by James Penstone on January 25, 2011 at 12:02 am, and is filed under Economics, IB Economics, IGCSE Economics. Follow any responses to this post through RSS 2.0. You can leave a response or trackback from your own site. |