Posts tagged Role of Government

How does elasticity of supply and demand affect incidence of tax?

Nov 2nd

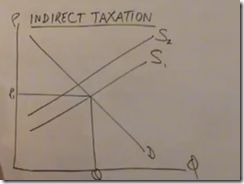

pajholden explains the effect of indirect taxation. Note he concentrates mainly on specific tax but includes a brief section on ad valorem (percentage) tax later on. Click below.

A much longer (and therefore detailed) video by jodiecongirl. Use these if you really haven’t yet understood the key concepts, as these will take you through it slowly and step by step.

She also goes into depth about the impacts on producers and consumers in the following videos but this gets quite complex. (more suited to IB level):

General Rules About Taxes Part 1

General Rules About Taxes Part 2

A much briefer summary is here by agsmandrew and he manages to explore the impact on consumer and producer surplus (including deadwight loss) (good for a quick revision for IB students):

Visit this site and explore different possibilities on a supply/demand graph with varying levels of tax applied. Try answering the questions at the bottom. (Note – the graph also refers to Efficiency Loss which is not actually required on the IGCSE syllabus, but is necessary to IB Economics).

![]() McConnell Brue Economics – Online Learning Centre – Interactive Graphing Exercise – Tax Incidence

McConnell Brue Economics – Online Learning Centre – Interactive Graphing Exercise – Tax Incidence

Taxation

Aug 19th

The syllabus requires that you able to do the following:

describe the types of taxation (direct, indirect, progressive, regressive, proportional) and the impact of taxation;

Direct versus Indirect

Compare these two definitions:

http://en.wikipedia.org/wiki/Direct_tax

http://en.wikipedia.org/wiki/Indirect_tax

Can you explain the difference between direct and indirect tax with example taxes?

Progressive, Regressive, and Proportional Tax

ONE Massachusetts demonstrates the different types of taxes:

The arguments surrounding and Impacts of these types of taxes (Progressive, Regressive, and Proportional)

An argument in favour of Progressive Taxes by David Cay Johnston:

An argument against progressive taxes by Mike Huckabee:

Specific Examples of Taxation

This mjmfoodie video includes specific examples of US taxes, then a section on how taxes relates to the government’s budget (which is worth understanding in general terms) and finally a section reviewing the general types of taxes.

A good overview of different taxes (some of which is a little complex):

http://lhepburn.com/team/work/media/Economics/notes/ch14/ch14.swf

Another complex web page (at times) which is aimed at education higher than IGCSE but includes some very useful info on this topic:

http://tutor2u.net/economics/revision-notes/a2-macro-direct-indirect-taxation.html

Testing Your Understanding

A ‘tic tac toe’ game which puts some of the above to the test but you may also need to use your common sense and a bit of guesswork. Play as two people.

Use this interactive activity to classify different examples of taxes (US based):

Another interactive quiz:

Grade or No Grade – Taxes – by Dinesh Bakshi

Although aimed for A Level (higher qualification than IGCSE) this is an excellent summary of the main points regarding tax:

Taxation by busniesstudiesonline

A discussion on different taxes – this is quite a complex discussion at times – how much of it do you understand having studied the above?